Chuck E. Cheese on the Brink of Bankruptcy

Company Information

Chuck E. Cheese was founded in 1977 in California, but currently runs out of Texas. There are 615 Chuck E. Cheese locations worldwide, with 610 of those being in 47 of the United States. The chain is owned by the brand CEC Entertainment.

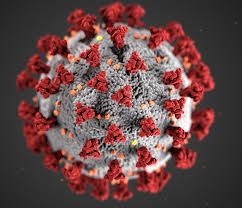

Struggles Due to the Coronavirus Pandemic

Although many restaurants have been able to continue serving takeout and delivery, Chuck E. Cheese quickly realized its clientele patronized them for their atmosphere and activities, not the pizza itself. Public video games and play equipment aren’t acceptable during the pandemic, as it would prevent an easy opportunity for the virus to spread. The chain reports that profits are down 21.9% from this time last year, and it has had to lay off 17,000 employees since March. The company also included that it was considering bankruptcy in this report. Despite all of these problems the chain announced it would be giving bonuses to three top executives to guarantee they stay with the company. If Chuck E. Cheese files bankruptcy due to the coronavirus pandemic, it will be joining the likes of big names like JC Penney, Neiman Marcus, and Pier 1 Imports.

In an effort to recoup some losses and avoid laying off and furloughing all of its employees, the company took a unique approach to sales during the pandemic. Eagle-eyed pizza eaters on delivery services noticed that a chain called “Pasqually’s Pizza and Wings” had the same exact addresses as Chuck E. Cheese. The chain created a pseudonym based on one of mascot’s band members to sell to those too embarrassed to be seen eating Chuck E. Cheese pizza.

Chuck E. Cheese and Chapter 11 Bankruptcy

In Chapter 11, the filer’s top creditors will form a panel to assist in reorganizing the bankruptcy debts. Along with the bankruptcy trustee assigned to the case, the panel will make sure that the reorganization is fair for the company and all of its creditors. The company can remain operating and maintain basic management decisions, big business decisions have to be approved by the panel. Alternative debt repayment methods, like ownership and stock options, may be available in a Chapter 11.

When filing bankruptcy, most companies choose between Chapter 11 and Chapter 7 bankruptcy. Chapter 7 liquidates unsecured non-priority debts. It also provides the option to surrender financed assets that are no longer a good investment. Only the trustee will oversee the case, and creditors can appear at the 341 Meeting of Creditors but not form a panel for the case. The drawback is that the company will be forced to cease operations. All of the company’s remaining assets must be surrendered and will be sold to be distributed amongst the company’s creditors.

Personal Bankruptcy Chapter 13 and Chapter 7

Personal bankruptcy filers also have the option to file Chapter 7 bankruptcy, along with Chapter 13. Filers will have their financial slate cleared of debts like credit cards and medical bills, but the benefits are not available to everyone. Assets must have not more equity in them than each state’s applicable exemption value. The filer must either make less than the state’s median monthly income for their number of family members, or prove their disposable monthly income is low enough through the Means Test. There are also waiting periods in between filing most chapters of bankruptcy. Those who don’t qualify for Chapter 7 will usually qualify for Chapter 13 bankruptcy.

Chapter 13 bankruptcy reorganizes debts into a payment plan that lasts 3-5 years, depending on the filer’s income relative to the state median. Some debts, like the balance on a car loan, or arrearages on child support, will be paid in full in the plan. Some unsecured debts may only receive a portion of the debt they are owed. Filers must prove they have enough income to feasibly make minimum monthly payments. There are also limits on how much debt they can have: $419,275 in unsecured debt and $1,257,850 in secured debts.

The spread of coronavirus has impacted businesses and individuals alike. If you are struggling, you should consider how bankruptcy may be able to help you. Our Mesa Bankruptcy Office offers free consultations to help you do just that. Call today to schedule a free consultation to speak to one of our experienced bankruptcy attorneys. We offer free consultations either in office or by phone. We look forward to assisting you.

Bankruptcy is a very helpful solution for challenging financial problems. For instance, several individuals have a big charge card debts that become very tough to be worthwhile. These individuals may simply have to create a fresh break with a painful fiscal past and start things over fresh.

Bankruptcy is a very helpful solution for challenging financial problems. For instance, several individuals have a big charge card debts that become very tough to be worthwhile. These individuals may simply have to create a fresh break with a painful fiscal past and start things over fresh.

Declaring bankruptcy stops wage garnishments from creditors where they are in the process. However, you won’t necessarily get any of the money back that has already been taken from you through the garnishment. The idea is to stop a garnishment before your creditors take action against you. That is the best way to assure that you won’t lose any of your hard-earned money in a garnishment.

Declaring bankruptcy stops wage garnishments from creditors where they are in the process. However, you won’t necessarily get any of the money back that has already been taken from you through the garnishment. The idea is to stop a garnishment before your creditors take action against you. That is the best way to assure that you won’t lose any of your hard-earned money in a garnishment. Sears Holdings is the parent company of Sears and Kmart. According to a recent public records, it is still operating 506 Sears locations (360 Kmart stores).

Sears Holdings is the parent company of Sears and Kmart. According to a recent public records, it is still operating 506 Sears locations (360 Kmart stores).