Stop Foreclosure in Mesa, AZ

Mesa Foreclosure Attorneys Give You Options

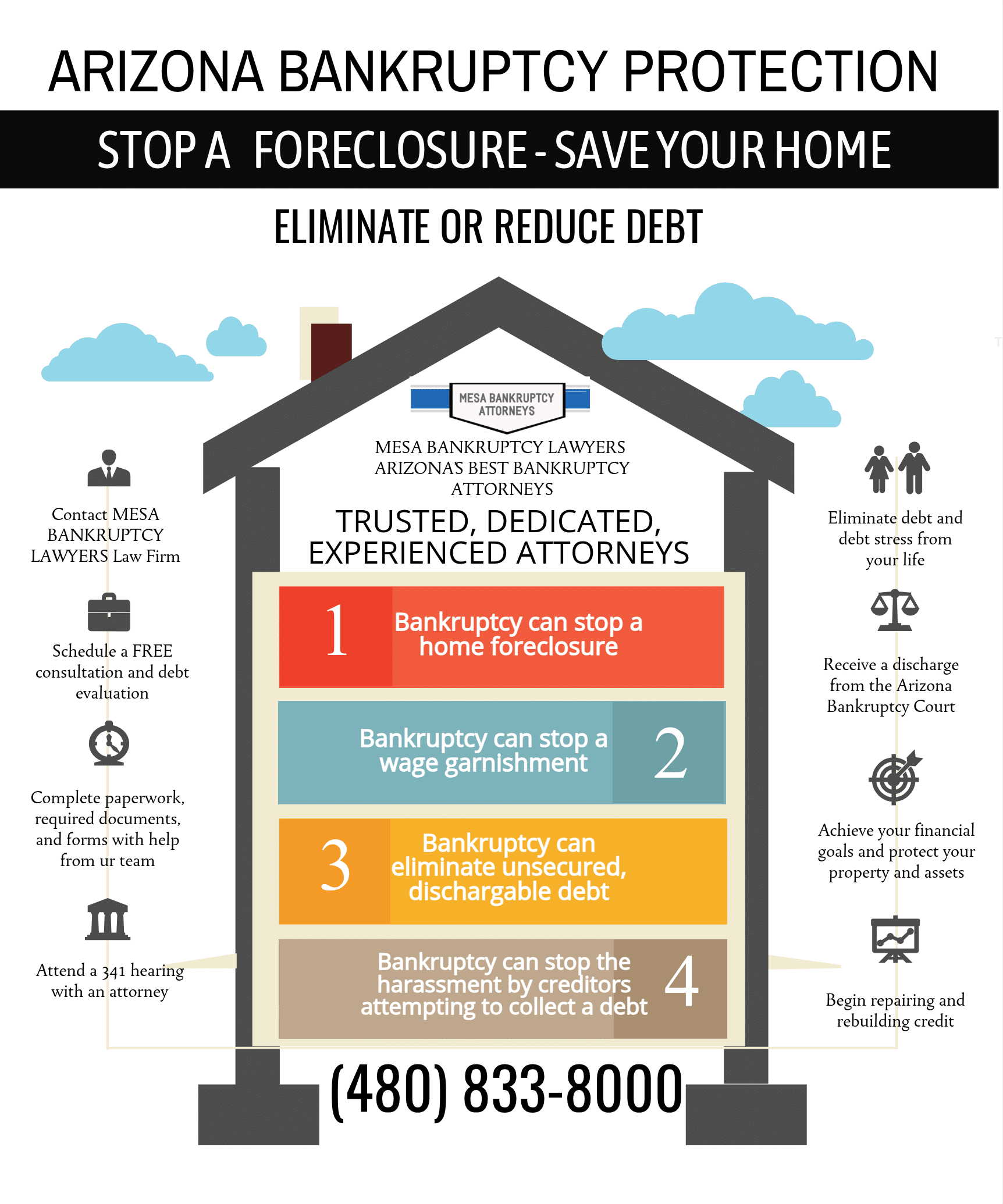

Mortgage lenders in Mesa and throughout Arizona have become more and more aggressive in pursuing foreclosures. Our Mesa foreclosure attorneys will provide you with options as to how to fight your foreclosure in Mesa. Our debt relief experts have foreclosure defenses that will benefit your needs.

More often than not, the banks or Arizona home lenders won’t even listen to why a borrower has fallen behind on their monthly payments. Their refusal to listen has forced many people throughout Maricopa County and Mesa, Arizona, and the Phoenix metro area into Chapter 13 bankruptcy or some alternate foreclosure solutions like a short sale or deed in lieu of foreclosure. Each foreclosure case has it’s unique set of circumstances and most situations have solutions that our lawyers can provide.

Find out from our Mesa foreclosure lawyers what method of debt relief is going to be the most beneficial to your foreclosure situation. Our lawyers have years of foreclosure and debt relief experience and are eager to help you through your time of need.

Filing for bankruptcy protection is a tool to save your house, and sometimes its the only tool you have! Our Mesa bankruptcy lawyers are experts with bankruptcy and foreclosure defense in Arizona. Let our professionals do the work for you and keep you where you belong… in your home.