Getting a speeding ticket is nothing more than a nuisance in most cases. You pay the fine, maybe you consult with an attorney, and you go on about your business. But if you are having financial troubles, a speeding ticket or other traffic citation can be a major blow. You may be struggling to figure out how you’re going to pay your mortgage this month, so a ticket that carries a fine and potential attorney fees can throw a major wrench into your finances.

When things are getting this bad, it might be time to consider filing for bankruptcy. Depending on what type of bankruptcy you file, you might be able to get your unsecured debts discharged (eliminated), or you might be able to negotiate a repayment plan that makes your monthly expenses more manageable.

Not all debts are discharged in a bankruptcy filing. Some people have questions about things like tax debts or student loans. Others are particularly interested in court fines and penalties. Here’s what you need to know:

Traffic Fines

Traffic fines are the most common government fines that the average person will get. You can get fines for speeding, parking in the wrong spot, driving with a broken headlight, and other minor infractions. Of course, you can also be fined for more serious infractions, such as driving under the influence or reckless driving.

Unfortunately, traffic fines cannot be discharged in a Chapter 7 bankruptcy. You will have to pay these no matter what your financial situation is.

Government Fines and Penalties

There are many other situations in which you might have to pay a government fine or penalty. You might be fined paying music at your party a little too late. Or you might get a fine if your dog gets out of the fence and is caught running around the neighborhood.

Again, any fines or penalties you owe to a court or other government entity cannot be discharged in a bankruptcy filing. You will be left with these bills, no matter what else happens in your bankruptcy.

How Bankruptcy Can Help with Fines

Though you can’t discharge court or government fines or penalties in a bankruptcy filing, there are other ways that filing for bankruptcy can help with these expenses.

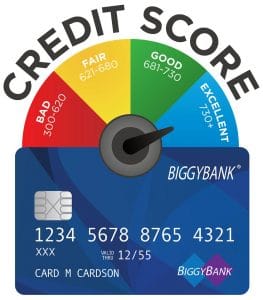

If you file for Chapter 7 bankruptcy, you can free yourself from excessive debts, such as credit cards with high balances and huge medical bills. When you no longer have to pay off those balances, you will have a lot more money each month, and that should give you the means to pay off your court fines and penalties.

If you file for Chapter 13 bankruptcy, you will have a debt repayment plan that will make it easier for you to pay each month. You will have one monthly payment in an amount that is manageable for your finances. In many scenarios, it is possible to include some court fines and penalties in your Chapter 13 repayment plan.

Working with an Attorney

A good attorney can help you fight charges that result in court fines and penalties. Though you might feel like you can’t afford the legal help, hiring an attorney can actually save you money in the long run. Depending on the circumstances of your case, your attorney might be able to get the charges dismissed and the fines dropped. Your attorney might also keep charges off your record, which can help with things like keeping your car insurance low, ensuring that you are able to get a job, and ensuring that you are able to get better credit.

An experienced bankruptcy attorney will help you understand your financial options and what the best debt-relief plan might be for you. Mesa Bankruptcy Lawyers can help you understand how bankruptcy can help you, and Mesa Bankruptcy Lawyers can help you with things like criminal charges, traffic violations, DUI cases, and personal injury claims, among other legal matters. Contact Mesa Bankruptcy Lawyers to talk about the fines and penalties you are facing and to explore your legal options for evading the charges or minimizing the fines. Our attorneys will do everything they can to help you avoid penalties and to get back on firm financial footing.

Create a budget.

Create a budget. Spend Any Extra Money You Have… On Your Debt

Spend Any Extra Money You Have… On Your Debt

We believe that the explanation above is clear, but we will break it up for you. Basically, a discharge declares that the debtor is not legally required to pay any debts that were discharge in court or through an attorney. Also, you will not be fully relief you from all your debts. However, the debts that were discharge, the creditors will stop taking any form of collection action on the discharge debts. That means no more phone calls or letters from the creditors. The discharge only focuses on debts, not a bankruptcy trustee. You need to have that very clear. A bankruptcy trustee will still be sending you a demand letters. Talk with your

We believe that the explanation above is clear, but we will break it up for you. Basically, a discharge declares that the debtor is not legally required to pay any debts that were discharge in court or through an attorney. Also, you will not be fully relief you from all your debts. However, the debts that were discharge, the creditors will stop taking any form of collection action on the discharge debts. That means no more phone calls or letters from the creditors. The discharge only focuses on debts, not a bankruptcy trustee. You need to have that very clear. A bankruptcy trustee will still be sending you a demand letters. Talk with your  If you believe you need to claim bankruptcy in the state of Arizona, you need the guidance of a bankruptcy lawyer from a reputable

If you believe you need to claim bankruptcy in the state of Arizona, you need the guidance of a bankruptcy lawyer from a reputable

Although it may not be easy, and you must be careful at all times, buying a home after filing for an Arizona bankruptcy is entirely possible. You have to be vigilant and make sure that all of your finances are in order. You should always keep in mind the troubles you went through before and during the bankruptcy. This is the only way that you can really avoid doing it again. You also need to be patient. You may think that once you file for bankruptcy, your troubles are over, but in order to prevent it from happening again, you can’t go back to your frivolous ways. Save your money, take time to gather yourself and your funds, and soon you will be perfectly capable of buying a home once again.

Although it may not be easy, and you must be careful at all times, buying a home after filing for an Arizona bankruptcy is entirely possible. You have to be vigilant and make sure that all of your finances are in order. You should always keep in mind the troubles you went through before and during the bankruptcy. This is the only way that you can really avoid doing it again. You also need to be patient. You may think that once you file for bankruptcy, your troubles are over, but in order to prevent it from happening again, you can’t go back to your frivolous ways. Save your money, take time to gather yourself and your funds, and soon you will be perfectly capable of buying a home once again.

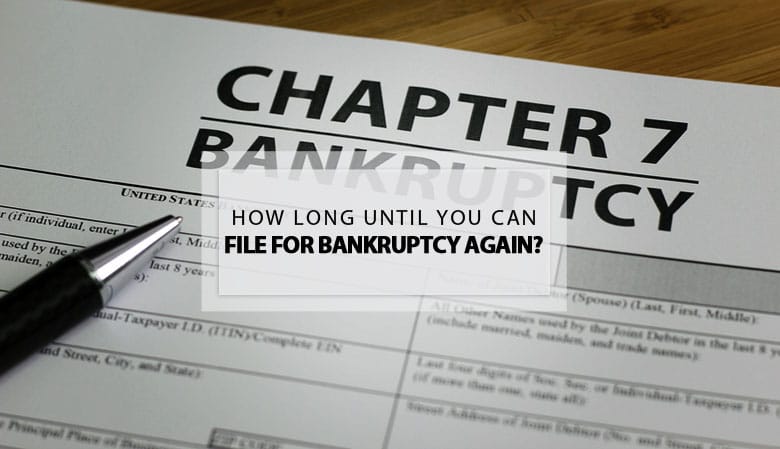

The shortest waiting time to file for bankruptcy will be if you are looking at a Chapter 13 after you have already filed for Chapter 13. You will be able to re-file after only two years from the date of your initial filing. Since most repayment plans are for three to five years, chances are good that you will still be under a Chapter 13 restructuring when you are permitted to file again.

The shortest waiting time to file for bankruptcy will be if you are looking at a Chapter 13 after you have already filed for Chapter 13. You will be able to re-file after only two years from the date of your initial filing. Since most repayment plans are for three to five years, chances are good that you will still be under a Chapter 13 restructuring when you are permitted to file again.

Global strategists are happy to report that there are no signs of a recession happening soon. The economy is growing, although at a slow pace. However, borrowing trends are appearing to rise at a rate higher than household incomes can handle. Most of this ties into the student loan crisis as well as increased auto loan debts this year. This trend may be something to be concerned about in the future, although these loan categories are modest. Sixty seven percent of all household debt in the United States is from mortgages, while nine percent accounts for student loans and less than seven percent account for auto loan debt. Hopefully, we can maintain our country’s current pleasant economic state and continue growing.

Global strategists are happy to report that there are no signs of a recession happening soon. The economy is growing, although at a slow pace. However, borrowing trends are appearing to rise at a rate higher than household incomes can handle. Most of this ties into the student loan crisis as well as increased auto loan debts this year. This trend may be something to be concerned about in the future, although these loan categories are modest. Sixty seven percent of all household debt in the United States is from mortgages, while nine percent accounts for student loans and less than seven percent account for auto loan debt. Hopefully, we can maintain our country’s current pleasant economic state and continue growing.