Filing for bankruptcy can be tricky, and even worse can be the consequences that come with it. If you are looking to file for bankruptcy with help from a Mesa bankruptcy attorney, you probably, no doubt, have a lot of questions that can’t rightfully be answered as sensitively as they should be. Before you take this step in trying to reclaim your financial security, you should make sure you have all of the facts first. Talk to your Mesa bankruptcy lawyer and get every detail you can before they help you sort out your financial troubles. Here are a few basic things you need to know before you do this.

The benefit to filing for bankruptcy is that once you do it, you will have no more debt. Unfortunately, this does not mean that you can spend exorbitant amounts of money. A lot of the times, the first thing that new bankruptcy victims want to do is to make a huge purchase like a house or a car. If you want to buy a house, a lot of lenders will want you to put down at least a 20% down payment. This may seem like a lot of money, but it is more secure for them to ask for this, especially when lending to someone who has just filed for bankruptcy. A good way to save up for this is to make sure that you cut your unnecessary expenses. Dining out, cell phones, cable charges, and excess spending. The larger the down payment, the more likely it is that you will get a better financing deal with a lender.

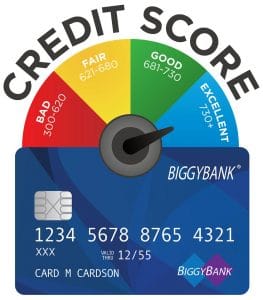

Another negative side effect of filing for bankruptcy in Mesa is that it leaves your credit in ruins. This is no secret. Having bad credit can bar you from making larger purchases that you might need to make in the future. Once you file for bankruptcy, you should automatically start rebuilding your credit so that you can eventually make those big purchases again. Your first step in doing this is to make sure you pay your debts as soon as possible. If you do this, your creditors will report to the credit bureaus that you have made your payments in a timely manner. If you owe money on your student loans, pay those in a timely manner. If you’ve purchased a car, make sure those are on time. Reaffirming your car loan if you are bankrupt will help restore your credit, and this will also be reported to the credit bureaus. But you should always make sure that it will be beneficial to you, because sometimes reaffirming your car loan can also be detrimental.

Sometimes credit lenders can be dishonest, so make sure to check your credit reports as frequently as possible to be absolutely positive that they are reporting your payments. If they aren’t, contact an Arizona bankruptcy lawyer to file a dispute and show proof of your payments. If you have reaffirmed your car after the bankruptcy instead of during the bankruptcy, this could be the result. In addition, if you get a credit card after you have filed for bankruptcy, make sure that you pay it off entirely within a two or three month period. This will get you much further in the endeavor of trying to reestablish your credit and make sure your credit score is increasing periodically.

Filing for an Arizona bankruptcy with a professional bankruptcy lawyer is as easy as calling My AZ Lawyers. With our friendly experts and our caring touch, you can have your bankruptcy filed and taken care of in a timely manner. Get your life back on track as well as your finances and make sure to schedule a free consultation with Mesa Bankruptcy Lawyers.

(480)833-8000

Mesa Bankruptcy Lawyers

4065 E University Dr #500

Mesa, AZ 85205

(480) 470-0005

Mesa Bankruptcy Lawyers | Bankruptcy Attorneys in Mesa

https://myazcriminaldefense.com/blogs/

https://phoenixdivorceattorneys.co/

https://glendalebankruptcyattorney.co/blog/

https://www.myazpersonalinjury.com/blog/

https://injurylawyersmesa.com/blog/

https://arizonabankruptcyattorneys.co/

https://gilbertbankruptcylawyers.com/blog/

https://hendersonbankruptcyattorneys.com/blog/

https://tucsonbankruptcyattorney.co/blog/

https://azfamilylawlawyer.com/blog/

https://avondalebankruptcylawyer.com/

https://mesaduilawyers.co/blogs-helpful-articles/

https://chandlerbankruptcyattorney.co/bankruptcy-blog/

https://mesabankruptcylawyers.co/blog/

https://chapterbankruptcylaw.com/blog/

https://vegaszerodownbankruptcy.com/blog/

https://arizonazerodownbankruptcy.com/blog/

https://lasvegasbankruptcylawyer.co/blog/