The trustee plays a very important role in a consumer bankruptcy filing. The trustee could cause a bankruptcy case to face delays or dismissal, or can push it in the direction towards discharge. The trustee is different from a judge, who will also be assigned to every bankruptcy case. Creditors may also be heavily involved in a debtor’s bankruptcy. Making sure that the trustee’s requirements can guarantee a debtor the best possible results out of their bankruptcy case. Finding a skilled bankruptcy lawyer will simplify every step of the bankruptcy process, including fulfilling trustee requests. While many firms make it expensive to retain quality representation, our firm offers affordable payment options that allow you to file your case with no money down. To schedule your free phone consultation with My AZ Lawyers, call 480-833-8000.

The Essential Functions Of a Bankruptcy Trustee In Arizona

A bankruptcy trustee is an attorney appointed by the government to your bankruptcy case. However, the bankruptcy is not working as your attorney like a court-appointed attorney for a criminal case might. The trustee doesn’t work as the affected creditors’ attorney, either. Instead, the trustee works with the court to make sure that a bankruptcy case is executed in accordance with United States Bankruptcy Code. The trustee’s responsibilities vary based on the type of case that the debtor files- Chapter 7, Chapter 13, or Chapter 11.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is filed more than any other type of bankruptcy. Chapter 7 bankruptcy can be used by consumers, or individuals, and businesses alike. Chapter 7 is regarded as a liquidation bankruptcy because the debtor must surrender all of their non-exempt assets to pay off debts. The trustee will review the debtor’s petition, which should include a schedule of their assets. The trustee will review this schedule to make sure that the correct exemptions are applied to each asset, and that the assets are worth what the petitioner says they are. The trustee will also make sure that the petitioner hasn’t transferred any assets to friends or family in recent history. This is important because without this precaution, a bankruptcy debtor could theoretically transfer a valuable asset that wouldn’t be protected by an exemption to a relative. This would result in an unfair distribution of assets to the creditors and an unfair benefit to the debtor.

Another big concern for Chapter 7 bankruptcy cases is credit card debt. Credit card debt is unsecured and non-priority, making it among the debts that can be wiped away by a Chapter 7 bankruptcy filing. This also creates a huge potential for abuse of the bankruptcy system. An unscrupulous debtor who intends to file for bankruptcy could open up as many credit cards for which they could obtain approval and spend them to the limits. The debtor would have no true intention of paying back these debts knowing that Chapter 7 bankruptcy was on the horizon. Therefore, there are limits on credit card spending in the time period before declaring Chapter 7 bankruptcy. The debtor is limited to $800 on luxury purchases in the 90 days before bankruptcy. Additionally, the debtor can’t make cash advances in excess of $1,100 in the 70 days before bankruptcy. If the trustee finds credit card spending that exceeds either of these limits, those debts may be excluded from discharge. The trustee will use their discretion to determine what is luxury spending versus ordinary necessities. The creditor can also raise the issue at the debtor’s 341 Meeting of Creditors.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is called the wage earner’s bankruptcy because it uses the debtor’s income to formulate a plan that will reorganize and pay off debts. The trustee will need to review the debtor’s petition for unprotected assets like in a Chapter 7 bankruptcy. Chapter 13 bankruptcy lasts either 3 or 5 years, and the debtor will need approval from the trustee before acquiring or removing significant assets from the bankruptcy estate. The trustee will be at the debtor’s 341 Meeting of Creditors like in a Chapter 7 bankruptcy, but there is another hearing mandatory for Chapter 13 filers. During the plan confirmation hearing, the trustee will make sure that the debtor has sufficient disposable monthly income to pay the debts that must be paid off in Chapter 13 bankruptcy. Bankruptcy fees, secured debts, and priority debts usually must be paid in full in a Chapter 13 payment plan.

Unsecured non-priority debts may be discharged without full repayment if the debtor completes the rest of the plan as intended.

Besides reviewing the petition and all of the debtor’s available financial information, it will be the trustee’s job in a Chapter 13 to collect and distribute the debtor’s payments among the creditors. The trustee may find it necessary to change the plan throughout its 3-to-5-year- course.

Chapter 11 Bankruptcy

Chapter 11 bankruptcy isn’t used regularly by consumers to discharge debts, but is available as an option. Chapter 11 bankruptcy allows business debtors to continue operating where a Chapter 7 bankruptcy would require shutting down operations. A key factor in Chapter 11 bankruptcy is that the debtor’s top creditors will join to form a committee that has authority on important decisions until the bankruptcy is complete. A trustee might not even be necessary in a Chapter 11 bankruptcy case. However, a trustee may be brought in to manage the debtor’s assets and affairs while the bankruptcy is pending. The trustee can also assist in the formation of the creditor committee.

What To Do When You Receive a Letter From The Trustee

Debtors who file for bankruptcy in Arizona will receive a letter from the trustee assigned to their cases shortly after filing. The trustee should provide the debtor with the date and time of their 341 Meeting of Creditors. The 341 Meeting of Creditors is generally held about 30-45 days after the petition is filed. If the hearing is remote, the debtor should make sure their software is up-to-date and they have a clean, quiet area to conduct the hearing before it begins. If the hearing is in person, the debtor should make sure they know how to get to the courthouse and where to park in advance.

The trustee may have issues they want the debtor to clear up before the 341 Meeting of Creditors. The trustee might request that the debtor provide financial documentation such as their most recent tax returns or pay stubs. If the debtor is unable to mail the trustee copies of these documents before the 341 Meeting of Creditors, they should be brought to the hearing. If you have additional questions about what to do when you receive a letter from your bankruptcy trustee, you should review the letter with your bankruptcy attorney.

Curious About Bankruptcy? Learn More From Our Experienced Arizona Bankruptcy Team

Bankruptcy could be a great way to get your finances back on track, or there may be a more effective method of debt relief available. There are many moving parts to a bankruptcy, and complying with trustee requests is just one of them. You have the right to hire a knowledgeable bankruptcy attorney who will simplify the process and make sure your debts are discharged efficiently. To schedule your free consultation with an experienced member of our bankruptcy team, contact us today at Mesa Bankruptcy Lawyers or call 480-833-8000.

1731 West Baseline Rd., Suite #101

Mesa, AZ 85202

Office: (480) 448-9800

Additional Information at:

Vegas Zero Down Bankruptcy Attorney

If you are considering

If you are considering  For years, Chuck E. Cheese has been a favorite for children, especially for birthday parties. The chain features pizza and other kid-friendly fare, along with video games, prizes, and play equipment. Unfortunately, like many restaurants and other businesses, COVID-19 has decimated profits for the past few months and for the unforeseeable future. The Kid’s Birthday Party/Restaurant may have to file for bankruptcy protection.

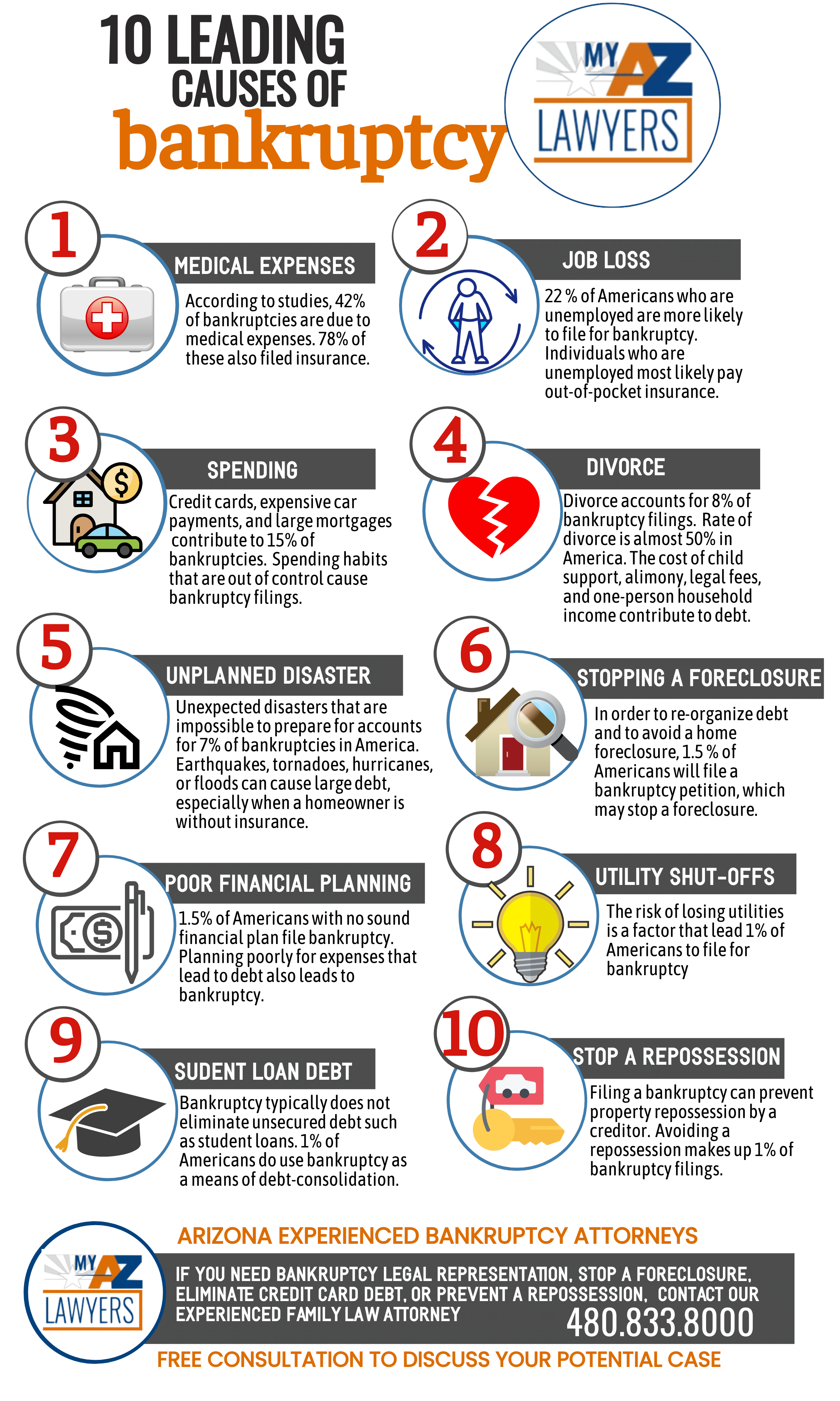

For years, Chuck E. Cheese has been a favorite for children, especially for birthday parties. The chain features pizza and other kid-friendly fare, along with video games, prizes, and play equipment. Unfortunately, like many restaurants and other businesses, COVID-19 has decimated profits for the past few months and for the unforeseeable future. The Kid’s Birthday Party/Restaurant may have to file for bankruptcy protection. If the chain files bankruptcy, it will more than likely utilize Chapter 11. Chapter 11 can be used by individuals and by businesses, usually those with significant assets and debts that will be particularly complicated to reorganize. Chuck E. Cheese specified that it would be a Chapter 11 filing if the company does end up filing bankruptcy.

If the chain files bankruptcy, it will more than likely utilize Chapter 11. Chapter 11 can be used by individuals and by businesses, usually those with significant assets and debts that will be particularly complicated to reorganize. Chuck E. Cheese specified that it would be a Chapter 11 filing if the company does end up filing bankruptcy. Bankruptcy is a very helpful solution for challenging financial problems. For instance, several individuals have a big charge card debts that become very tough to be worthwhile. These individuals may simply have to create a fresh break with a painful fiscal past and start things over fresh.

Bankruptcy is a very helpful solution for challenging financial problems. For instance, several individuals have a big charge card debts that become very tough to be worthwhile. These individuals may simply have to create a fresh break with a painful fiscal past and start things over fresh.